News

- All

- 2012

- 2013

- 2014

- 2015

- 2016

- 2017

- 2018

- 2019

- 2020

- 2021

24 September, 2021

0 Comments

bolttech extends Series A funding round to US$210 million

21 September, 2021

0 Comments

FWD Group completes investment in BRI Life Indonesia

04 March, 2021

0 Comments

HKT targets Hong Kong 5G first

20 March, 2020

0 Comments

PCCW Solutions acquires Singapore-based HCL Insys

18 November, 2019

0 Comments

Vietcombank, FWD Group sign 15-year bancassurance partnership

12 November, 2019

0 Comments

FWD completes acquisition and names new CEO for SCB Life

28 September, 2019

0 Comments

“Get Used to Market Volatility, It’s Not Going Anywhere”

07 January, 2019

0 Comments

“Outlook 2019: Rising above the business cycle”

14 November, 2018

0 Comments

“PineBridge Investments pulls in $880M for secondaries fund”

24 October, 2018

0 Comments

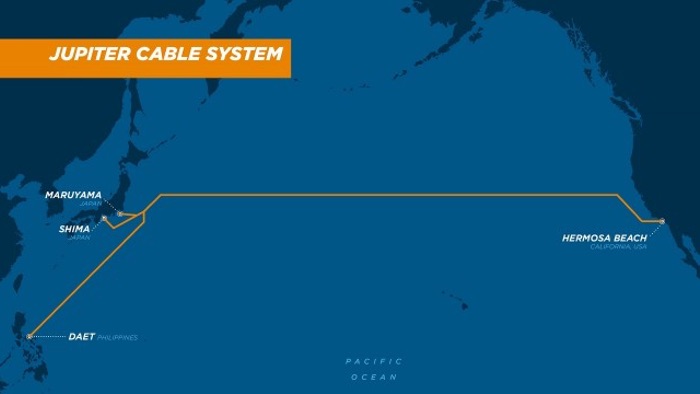

“Consortium to build 14,000km undersea cable linking Asia and US”

03 November, 2017

0 Comments

- 1

- 2